The Prodrisk price model#

Price in the algorithm#

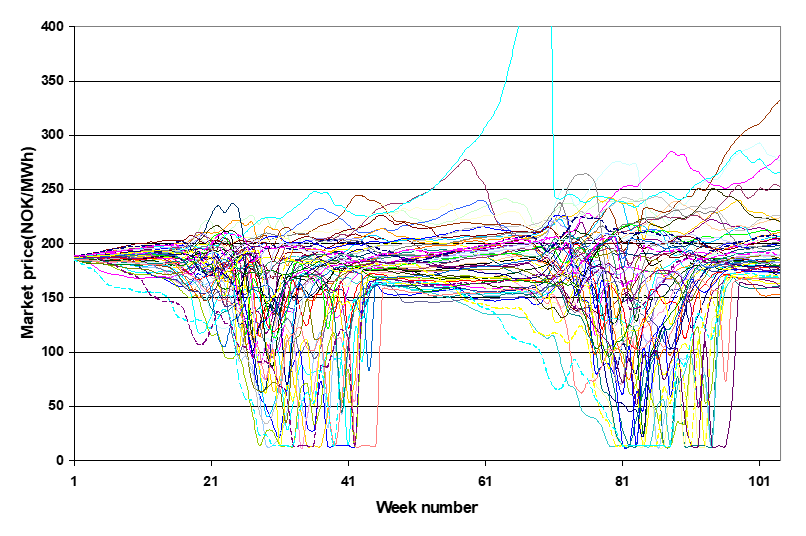

The price enters the objective function of Prodrisk and is a state variable in the planning in the sense that the price in one week is dependent on the price in the previous week. However, as the relationship between revenue and price is nonconvex, the price is not included in the SDDP algorithm. In the forward simulations, price prognoses are used directly in the shape of time series. The price time series conserve the correlation with inflow in the forward simulations.

Price nodes and price profiles#

In the backward recursions, the price is discretized and added in an additional loop. The discretized prices are called price_nodes or price points. The price nodes are generated from the price time series that are used in the forward simulations. The file pricefilename.PRISMOD describes the price periods, the price nodes and the transition probabilities for going from one node in one time step to the other nodes in the next time step. For each week in the Prodrisk backward recursion, a precomputed price profile belonging to this week is used together with the price node. The price profile represents the price variation for the various price periods within that week, relative to the average price in that week. The price profile is averaged over all historical simulation scenarios and price scenarios. Cuts are calculated and stored per price node.

In the current version of Prodrisk, the weekly price profile is calculated by first summarizing the price for each price period over all simulation scenarios. Then a mean accumulated price is calculated for each week by multiplying the sum for each price period with the share of the week for this price period. Then for each week and for each price period, the first computed sum is divided by the mean accumulated price for that week. The result is a normalized price profile that can be multiplied with the mean price of that week to find the actual price of that price period for that week. As an alternative, the node dependent price profile was developed, see Node dependent price profile.

The user specifies the number of price nodes N and the minimum number of scenarios Nmin used to define one price node. For a given Nmin minimum number of scenarios, the lowest price node (Pmin) for a week is given by the average value of the Nmin lowest scenarios, and the highest price node (Pmax) for a week is given by the average value of the Nmin highest scenarios. The price interval between Pmin and Pmax is divided into N-2 intervals of same length, and the price nodes are found as the average of all scenarios in each interval. The initial transition probabilities are found by counting the transitions from one week to another. Additionally, the conditionally expected market price one week ahead must be the same as in the price scenarios. This is formulated as a quadratic optimization problem, giving modified transition probabilities.